There’s definitely no shortage of research showing the irrelevance of clicks as an indicator of online campaign value. Our own experience shows it and Nielsen data proves it. This probably has a lot to do with the fact that the folks doing the clicking are a small portion of population and demographically far from the top of most advertisers’ target lists. None of this is news, yet there remains a surprising (shocking?) amount of attention paid to click-based “optimization” of campaigns. Perhaps it’s the crack-like allure that Cory Treffiletti from Catalyst SF discusses in a fun piece from last fall.

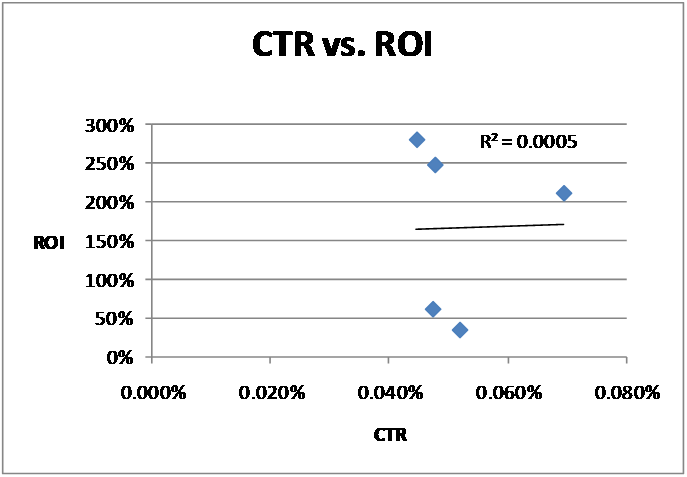

For all the richly deserved bad press the click has gotten as a metric, I hadn’t seen anyone focus on the angle that chasing clicks actually works against driving the metrics that do matter (much like how chasing crack limited addicts’ success in other more meaningful pursuits…). That was the point of Monday’s article by Lotame’s Eric Porres. Lotame’s research across >100 campaigns shows that “not only do click-through rates fail to measure what marketers are really looking for, they’re often negatively related to brand lift.” While I haven’t seen the research myself, it looks like it was done based on third-party data from Vizu and Dimestore – both reputable survey technologies. The findings would also comport with previous research.

The bottom line is that there is no free lunch. There are tradeoffs that must be made when planning & managing media. “Optimizing” for a metric that doesn’t matter isn’t just a waste of everyone’s time, it actually degrades performance against the metrics that do matter.